7 Best Payment Gateways for Ecommerce in the UK (2026 Roundup)

0

2

0

Selecting the right payment gateway is one of the most critical decisions for any UK ecommerce business. It's not just about accepting money; it's about creating a smooth, secure, and trustworthy checkout experience that boosts conversions and builds customer loyalty. A poor choice can lead to abandoned carts, high transaction fees, and administrative headaches. Choosing incorrectly can directly impact your bottom line and customer satisfaction, making this decision a foundational pillar of your online store's success.

This guide is designed to cut through the complexity. We will break down the 7 best payment gateways for ecommerce businesses in the UK, focusing on the crucial factors you need to consider. We'll examine everything from transaction fees and supported currencies to fraud protection and, most importantly for many, seamless integration with platforms like Wix. You will find clear pros and cons for each option, specific recommendations for different business models, and actionable setup tips to get you started quickly. For those needing deeper, specialised advice, the resources provided by dedicated payment experts can offer additional insights into bespoke payment solutions.

Whether you're a small startup launching on Wix or a rapidly scaling international brand, this breakdown will help you make an informed decision that supports your business's growth. Each review includes direct links and practical details to help you compare providers effectively. Let's find the perfect payment partner to optimise your checkout process and drive your business forward.

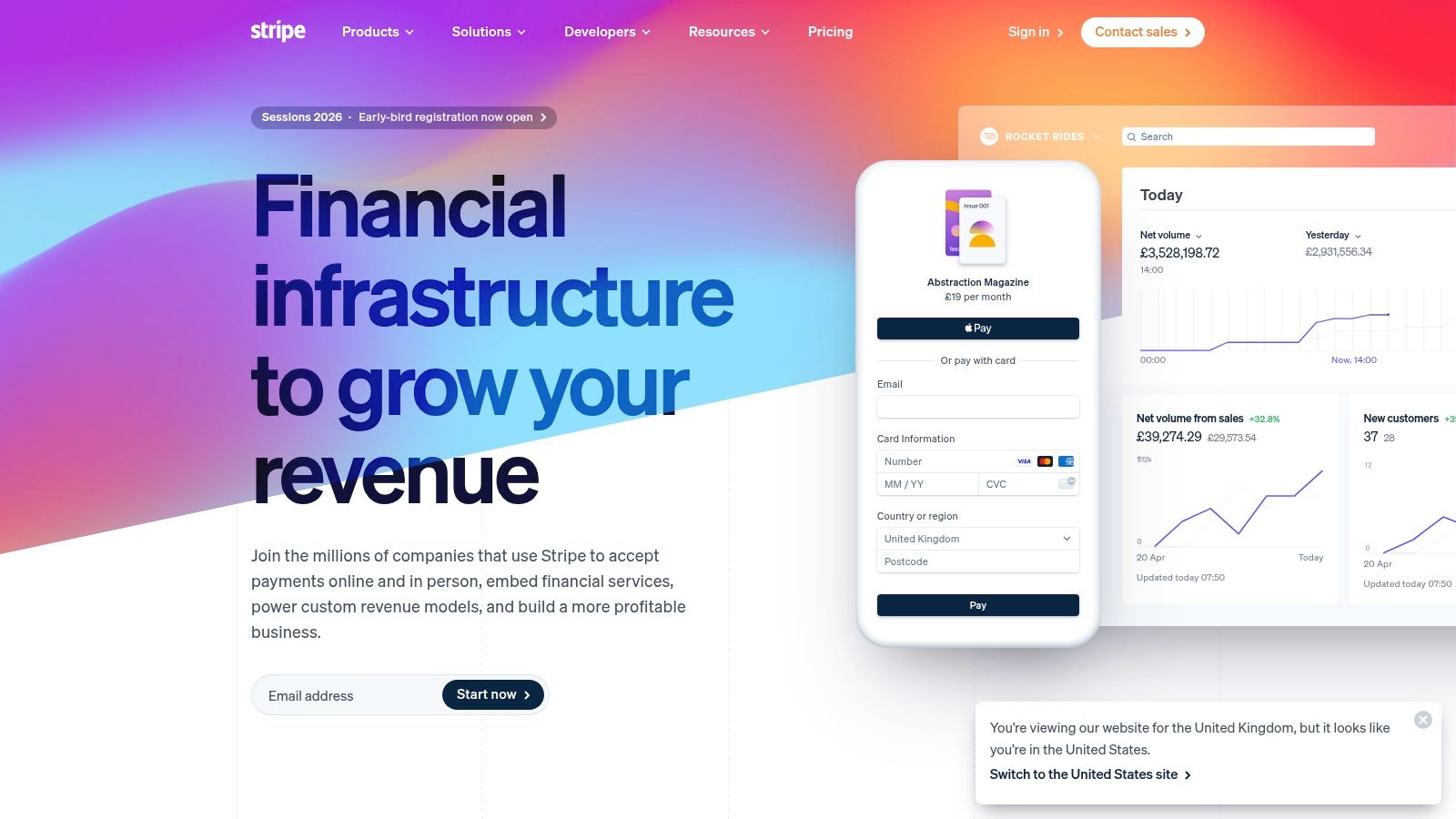

1. Stripe (UK)

Stripe has become the default payment infrastructure for millions of businesses, from ambitious startups to global enterprises. For UK-based ecommerce stores, it represents one of the best payment gateways due to its powerful combination of developer-friendly tools, transparent pricing, and a relentless focus on maximising conversion. It simplifies the complex world of online payments into a cohesive, API-driven platform that scales seamlessly as your business grows.

Stripe's core strength lies in its flexibility. You can get started in minutes with pre-built solutions like Stripe Checkout or Payment Links, which require no code. For those wanting more control over the user experience, Stripe Elements provides embeddable UI components to design a fully custom checkout form on your own site. This versatility makes it ideal for both a new Wix store owner and a high-growth brand with a dedicated development team.

Key Features and UK Pricing

Stripe supports an extensive range of payment methods crucial for the UK and European markets, including all major credit and debit cards, digital wallets like Apple Pay and Google Pay, and direct debit schemes like Bacs. This broad support ensures customers can pay using their preferred method, which is a key factor in reducing abandoned carts.

UK Pricing Structure:

Standard UK cards: 1.5% + 20p

EEA cards: 2.5% + 20p

All other international cards: 3.25% + 20p

Chargebacks: £20 fee per dispute (refunded if you win)

The platform also includes a suite of tools designed to optimise revenue. Radar, its machine-learning-based fraud protection system, helps you distinguish fraudsters from legitimate customers, while features like Adaptive Acceptance intelligently retry network declines in real-time.

Practical Tip for Wix Users: When integrating Stripe with your Wix store, enable both Apple Pay and Google Pay within the Stripe settings. This adds one-click payment options to your product and checkout pages, dramatically speeding up the process for mobile shoppers and boosting conversion rates.

Pros and Cons

Pros | Cons |

|---|---|

Transparent and competitive UK pricing | Advanced customisation requires developer skills |

Excellent documentation and developer tools | Chargeback disputes incur a £20 fee |

Scales from small businesses to enterprise-level | International payments carry higher surcharges |

Strong support for subscriptions and marketplaces | Payouts can take several days to reach your bank |

Stripe is an exceptional all-rounder that provides a robust and reliable foundation for any ecommerce business. Its developer-first ethos, combined with powerful no-code tools, offers a clear growth path.

Visit Stripe (UK) to learn more and create your account.

2. PayPal (PayPal Checkout and Online Card Payments)

PayPal is one of the most recognised and trusted digital payment brands in the world, making it a powerful addition to any ecommerce checkout. For many online shoppers, the familiarity of the PayPal button provides a sense of security and convenience that can significantly boost conversion rates. Beyond its ubiquitous digital wallet, PayPal also offers robust solutions for accepting card payments directly on your site, making it a versatile option for UK businesses.

The primary advantage of PayPal is its massive user base. Millions of customers have their payment details saved, allowing for a fast, frictionless checkout experience without needing to find and enter card information. It can be integrated as a primary gateway or, more commonly, as a supplementary payment method alongside a provider like Stripe. This dual approach gives customers choice, which is a cornerstone of a high-converting checkout process, especially when you're just starting an online store in the UK.

Key Features and UK Pricing

PayPal provides a range of solutions, from a simple "Pay with PayPal" button (PayPal Checkout) to a more integrated system for processing card payments directly (PayPal Payments Pro). It also offers popular alternative payment methods like Pay in 3, a "buy now, pay later" option that can increase average order value. Both Buyer and Seller Protection policies add an extra layer of security to transactions, helping manage disputes.

UK Pricing Structure (Standard):

UK commercial transactions (online): 2.9% + 30p

UK QR code transactions (over £10): 1.5% + 10p

International payments: Fees vary, typically adding a 1.29% to 1.99% cross-border fee

Chargebacks: £14 fee per dispute

PayPal's fee structure can be more complex than its competitors, with different rates for various transaction types, currency conversions, and cross-border sales. Careful review of their fee schedule is recommended to understand the true cost for your specific business model.

Practical Tip for Wix Users: Enable PayPal as an additional payment option in your Wix dashboard, even if you use another gateway for primary card processing. The presence of the trusted PayPal logo at checkout can reassure hesitant buyers and capture sales from customers who prefer not to enter their card details directly on a site.

Pros and Cons

Pros | Cons |

|---|---|

Highly recognised brand that builds customer trust | Fee structures can be complex and less transparent |

Quick and easy for customers with PayPal accounts | Settlement and dispute policies differ from card acquirers |

Simple to add as a secondary payment option | Can be more expensive than competitors for card payments |

Strong buyer and seller protection features | Reconciliation can be more complex at a larger scale |

For many businesses, PayPal isn't just a payment gateway; it's a conversion tool. Its immense brand recognition makes it a near-essential option to offer customers, particularly for new or smaller stores looking to build credibility.

Visit PayPal for Business to explore their payment solutions.

3. Worldpay (UK) – Worldpay eCommerce

Worldpay is a stalwart of the UK payments industry, offering a bank-backed payment gateway solution that combines reliability with a comprehensive feature set. For UK small and medium-sized enterprises (SMEs), it stands out as one of the best payment gateways for ecommerce by providing the trust of a major acquirer with transparent online pricing and strong, accessible customer support. Its platform is designed for businesses that value security, dependability, and fast access to their funds.

Unlike many modern fintech platforms that are API-first, Worldpay’s strength lies in its established infrastructure and all-in-one service model. It handles both the gateway and acquiring services, simplifying the process for merchants. The easy online application and clear pay-as-you-go pricing make it particularly appealing for businesses that want a straightforward, powerful payment solution without navigating complex developer documentation or variable fees.

Key Features and UK Pricing

Worldpay supports a wide array of payment methods, including major debit and credit cards, digital wallets, and crucial multi-currency acceptance in over 110 currencies. This global reach is essential for UK businesses looking to sell internationally. A significant advantage is the inclusion of next-business-day settlement on its pay-as-you-go plans, a feature often reserved for premium or custom plans with other providers.

UK Pay-As-You-Go Pricing Structure:

Standard UK cards: 2.75% + 20p

Commercial cards & Amex: Rates may vary

International cards: Rates may vary

Chargebacks: Fees apply and vary

The platform includes powerful tools like FraudSight for risk management and APIs for recurring payments and subscriptions. This makes it a versatile choice capable of supporting various ecommerce business models, from simple online shops to more complex subscription services.

Practical Tip for Wix Users: When setting up Worldpay with Wix, take advantage of the 'Payment Links' feature. You can create a unique, shareable link for a specific product or invoice and send it directly to a customer via email or social media. This is an excellent way to secure sales outside of your standard checkout flow, such as for custom orders or B2B transactions.

Pros and Cons

Pros | Cons |

|---|---|

Clear, published UK pay-as-you-go pricing | Base transaction rate is higher than some rivals |

Next-business-day settlement included | Pricing for commercial and international cards can vary |

Strong UK presence and 24/7 customer support | Custom pricing may require more negotiation |

Robust fraud protection tools (FraudSight) | Interface can feel less modern than newer platforms |

Worldpay offers a secure and highly dependable payment gateway, ideal for businesses that prioritise stability, fast payouts, and the backing of a major financial institution.

Visit Worldpay eCommerce to get started and view their plans.

4. Checkout.com

Checkout.com is a London-founded, enterprise-grade payment processor designed for high-growth ecommerce businesses and global marketplaces. It stands out by offering a modular, API-first platform that provides granular data and sophisticated tools to optimise authorisation rates. For UK brands looking to scale internationally or refine their payment strategy with deep analytics, Checkout.com is one of the best payment gateways for achieving peak performance.

Unlike all-in-one solutions that offer a standard package, Checkout.com provides a more tailored experience. Its core strength is its unified Payments API, which gives businesses direct access to domestic acquiring in over 45 countries. This allows for local payment processing, which typically results in higher acceptance rates, lower fees, and faster settlement times, a significant advantage for businesses with a large European or international customer base.

Key Features and UK Pricing

Checkout.com supports a vast array of payment methods, including all major cards, popular digital wallets like Apple Pay and Google Pay, and numerous local payment options critical for cross-border sales. The platform's real power comes from its advanced analytics and machine-learning fraud detection engine, Fraud Detection Pro, which helps businesses create custom risk rules to maximise conversions while minimising fraudulent transactions.

UK Pricing Structure:

Pricing model: Custom-quoted based on volume, business model, and risk profile.

Available structures: Interchange++, flat-rate, or blended pricing options are available upon discussion.

How to get pricing: You must contact their sales team for a bespoke quote tailored to your business needs.

This tailored approach means there is no public price list. While this requires an initial conversation, it often results in more competitive rates for high-volume merchants compared to one-size-fits-all models.

Practical Tip for Wix Users: While a direct, self-service Wix integration for Checkout.com may not be as straightforward as with other gateways, you can work with a developer to connect via its API. For businesses on platforms like Shopify or WooCommerce, the integration is much simpler and allows you to leverage its superior authorisation rates to recover potentially lost revenue.

Pros and Cons

Pros | Cons |

|---|---|

Granular data and powerful analytics | Not ideal for very small startups or sole traders |

Excellent for international and multi-region sales | Pricing is not transparent and requires a sales call |

Flexible and often competitive pricing for scale-ups | Integration can be more complex than competitors |

Strong focus on maximising payment authorisation rates | Lacks a simple, out-of-the-box solution for beginners |

Checkout.com is a formidable choice for established ecommerce businesses focused on data-driven growth and international expansion. Its powerful infrastructure and bespoke service provide the tools needed to optimise every aspect of the payment flow.

Visit Checkout.com to request a quote and explore their solutions.

5. Adyen

Adyen offers a unified, end-to-end payment platform designed for mid-market to enterprise-level businesses with global ambitions. It acts as a direct acquirer, processor, and gateway, consolidating the entire payment lifecycle into a single integration. For ecommerce businesses planning significant international expansion, Adyen provides a powerful infrastructure that simplifies cross-border commerce, optimises revenue, and delivers consistent customer experiences across all channels.

The platform’s core strength is its single-system approach. By handling everything from payment processing to risk management and acquiring in-house, Adyen provides businesses with rich, unified data. This allows for deeper customer insights and more effective decision-making. This unified commerce model is ideal for retailers who operate both online and in physical stores, as it bridges the gap between digital and in-person payments.

Key Features and UK Pricing

Adyen’s all-in-one platform supports a vast array of local payment methods worldwide, enabling merchants to cater to regional preferences without multiple integrations. This is a crucial element for successful international expansion. Its system is built on modern infrastructure that uses data to improve authorisation rates and reduce involuntary churn, which directly impacts your bottom line. It provides a deep dive into your payments data, offering insights you can use for ecommerce conversion rate optimisation that works.

UK Pricing Structure:Adyen uses an Interchange++ pricing model, which is highly transparent but more complex. It consists of a fixed processing fee plus the variable scheme and interchange fees.

Processing fee: £0.10 per transaction

Payment method fee: Varies by method (e.g., Visa/Mastercard fees are Interchange++).

The platform’s robust risk management tool, RevenueProtect, uses machine learning to identify and block fraudulent transactions while maximising approvals for legitimate customers. This tailored approach helps businesses find the right balance between security and a frictionless checkout experience.

Practical Tip for Wix Users: While Adyen is typically for larger enterprises, if your Wix store is scaling rapidly with international sales, Adyen becomes a viable option. Before committing, use their transparent pricing model to calculate your potential costs based on your specific sales volume and target countries to see if it’s more cost-effective than a percentage-based provider.

Pros and Cons

Pros | Cons |

|---|---|

Unified platform for acquiring, risk, and gateway | Pricing model is more complex than flat-rate options |

Extensive global payment method support | Better suited for enterprise than small merchants |

Rich, consolidated data and reporting tools | Can seem less "plug-and-play" than competitors |

High reliability and scalability for large volumes | Onboarding process is more involved |

Adyen is one of the best payment gateways for ecommerce businesses that have reached a scale where optimising global payments and unifying data across channels becomes a primary strategic goal. Its powerful, all-in-one infrastructure provides a solid foundation for complex, international operations.

Visit Adyen to explore its enterprise solutions.

6. Square (UK)

Originally known for its iconic point-of-sale (POS) hardware, Square has evolved into a comprehensive commerce ecosystem that makes it one of the best payment gateways for ecommerce businesses, particularly those operating both online and in-person. For UK small businesses, Square offers a refreshingly simple and integrated approach to payments. It removes the friction of managing separate systems for online and offline sales, presenting everything in one cohesive dashboard.

Square’s primary advantage is its simplicity and speed of setup. You can create an account and start accepting payments in minutes using tools like Square Online Checkout links or by building a free Square Online store. This accessibility is perfect for businesses that need to get to market quickly without technical overheads. For more customised solutions, its Web Payments SDK allows for embedding a secure payment form directly into your existing website.

Key Features and UK Pricing

Square supports all major credit and debit cards, along with digital wallets like Apple Pay and Google Pay. It also offers integration with Clearpay, allowing you to provide a "Buy Now, Pay Later" (BNPL) option, which can significantly increase conversion rates. Its standout feature is the seamless synchronisation between online payments and its renowned POS hardware, making it a powerful omnichannel solution.

UK Pricing Structure:

UK & EEA cards (online): 1.4% + 25p

All other international cards (online): 2.5% + 25p

Clearpay (BNPL): 6% + 30p

Payouts: Next business day transfer as standard

The platform provides a clear, flat-rate pricing model without monthly fees or long-term contracts for its standard plans. Features like its analytics dashboard provide valuable insights into sales trends across all your channels, helping you make smarter business decisions.

Practical Tip for Wix Users: When connecting Square to your Wix store, take advantage of its integrated inventory management. If you also sell in-person using Square POS, your stock levels will automatically sync between your physical pop-up and your Wix website, preventing overselling and simplifying stock control.

Pros and Cons

Pros | Cons |

|---|---|

Transparent, flat-rate UK pricing | Advanced features are less extensive than enterprise gateways |

Excellent for omnichannel retail (online + in-person) | BNPL and international card fees are higher |

Very fast and easy setup process | Customisation requires some development knowledge |

Next-business-day payouts are standard | Fewer direct integrations with niche third-party apps |

Square is the ideal choice for UK small businesses, sole traders, and retailers seeking a unified and straightforward system to manage all their sales. Its strength lies in its simplicity and powerful omnichannel capabilities.

Visit Square (UK) to explore its features and get started.

7. Wix Payments

For businesses built on the Wix platform, Wix Payments is the native, fully integrated solution designed to deliver the most seamless experience possible. It removes the need for a third-party gateway by unifying your website management, ecommerce operations, and payment processing into a single dashboard. This integration makes it one of the best payment gateways for ecommerce merchants who prioritise simplicity, speed of setup, and centralised administration.

The primary advantage of Wix Payments is its deep integration with the Wix ecosystem, including Wix Stores, Bookings, and Events. Setup is often a matter of a few clicks, allowing you to start accepting payments almost instantly without managing separate accounts or complex API keys. Everything from sales reports to refunds and chargeback disputes is handled directly within your familiar Wix admin panel, streamlining your daily workflow significantly.

Key Features and UK Pricing

Wix Payments supports all major credit and debit cards, as well as digital wallets like Apple Pay and Google Pay, ensuring a smooth checkout process for your customers. For UK merchants, it also integrates with popular Buy Now, Pay Later (BNPL) services like Klarna and Clearpay, which can be enabled to boost conversions. Additionally, it connects with Wix POS hardware for businesses that sell both online and in-person.

UK Pricing Structure:

Credit/Debit Cards: 1.9% + 20p

Apple Pay / Google Pay: 1.9% + 20p

Klarna (Pay in 3/4): 2.99% + 20p

Clearpay (Pay in 4): 4.99% + 20p

Chargebacks: £15 fee per dispute (refunded if you win)

The platform consolidates all your earnings, making financial reconciliation straightforward. This is especially beneficial for service-based businesses; you can learn more about how a native payment system supports a streamlined Wix booking system and simplifies appointment management.

Practical Tip for Wix Users: When setting up Wix Payments, take a moment to configure your payout schedule. You can choose between daily, weekly, or monthly payouts to align with your business's cash flow needs. This small step can make a big difference in managing your finances effectively.

Pros and Cons

Pros | Cons |

|---|---|

Fastest and simplest setup for Wix websites | Can only be used with the Wix platform |

Unified dashboard for site, sales, and payments | Not as portable if you decide to migrate away from Wix |

Clear, competitive UK transaction fees | Cross-border and currency conversion fees can apply |

Built-in support for Wix POS for physical sales | Fewer advanced customisation options than Stripe |

Wix Payments is the definitive choice for merchants committed to the Wix ecosystem. Its convenience and perfect integration offer an unmatched user experience for site owners who value simplicity and efficiency.

Visit Wix Payments to get started with integrated online payments.

Top 7 Ecommerce Payment Gateways Comparison

Provider | Implementation 🔄 | Resource requirements ⚡ | Expected outcomes ⭐📊 | Ideal use cases 💡 | Key advantages |

|---|---|---|---|---|---|

Stripe (UK) | 🔄 Medium–High — developer-first; advanced features need implementation | ⚡ Moderate — SDKs, dev time; scalable infra | ⭐ High conversion & control; 📊 strong subscriptions, marketplaces, fraud tools | 💡 Startups → mid-market needing custom checkout, subscriptions, marketplaces | Unified API & UIs, wide payment-method support, transparent UK card pricing |

PayPal (Checkout & Card Payments) | 🔄 Low–Medium — hosted quick-add; APIs for custom flows | ⚡ Low — minimal for hosted; moderate for virtual terminal/Pro | ⭐ Moderate uplift via brand trust; 📊 useful as additional tender | 💡 Merchants wanting wallet option to boost conversion or add secondary payment type | Widely recognized wallet, hosted checkout, buyer/seller protections |

Worldpay (UK) – eCommerce | 🔄 Low–Medium — PAYG simple; standard integrations | ⚡ Low–Moderate — easy online onboarding; UK support | ⭐ Reliable settlement; 📊 next‑business‑day funds on PAYG plans | 💡 UK SMEs seeking bank-backed provider with fast settlement | Clear published UK pricing, strong UK support, FraudSight risk tools |

Checkout.com | 🔄 Medium–High — enterprise-grade integration and orchestration | ⚡ Moderate–High — implementation & analytics work | ⭐ High authorization rates; 📊 deep data and authorization optimization | 💡 Scaling UK/EU brands and marketplaces needing advanced analytics | ML fraud tools, detailed analytics, flexible pricing models |

Adyen | 🔄 Medium–High — single integration for acquiring + gateway; more complex onboarding | ⚡ Moderate — enterprise support; commercial negotiation | ⭐ Very high reliability; 📊 consolidated reporting across channels | 💡 Mid-market → enterprise expanding internationally with multi-region needs | Unified acquiring + gateway, global payment-method coverage, consolidated data |

Square (UK) | 🔄 Low — plug‑and‑play with integrated POS and online tools | ⚡ Low — minimal setup, published fees, next‑day transfers | ⭐ Good for omnichannel starters; 📊 simple analytics/dashboard | 💡 Small UK businesses wanting simple in-person + online solution | Transparent pricing, integrated POS + online ecosystem, fast setup |

Wix Payments | 🔄 Very Low — native to Wix sites; one-vendor solution | ⚡ Very Low — managed in Wix admin, little dev work | ⭐ Adequate for Wix merchants; 📊 unified site + payments reporting | 💡 Merchants using Wix Stores/Bookings who want fastest go-live | Built-in checkout, consolidated admin, fastest to launch on Wix |

Final Thoughts: Making Your Payment Gateway Work for You

Selecting from the myriad of best payment gateways for ecommerce can feel like one of the most technical and high-stakes decisions you'll make for your online store. Yet, as we've explored, this choice is less about finding a single "best" provider and more about identifying the right partner for your unique business journey. The ideal gateway should function as a silent, reliable engine for your revenue, enhancing customer trust and simplifying your operations, not complicating them.

Throughout this guide, we've dissected the top contenders available to UK businesses, from the developer-centric power of Stripe to the ubiquitous familiarity of PayPal and the enterprise-grade solutions offered by Adyen and Worldpay. Each has a distinct profile, tailored to different business models, scales, and ambitions.

Recapping Your Core Decision Factors

Your final choice will pivot on a handful of critical factors. Let's revisit the most important takeaways to guide your decision-making process:

Cost vs. Value: Don't let transaction fees be your only guide. A slightly higher fee from a provider like Stripe might be justified by its superior developer tools, extensive integrations, and robust fraud prevention, saving you time and money in the long run. Conversely, a straightforward, all-in-one solution like Wix Payments can offer unparalleled simplicity and predictable costs for those just starting out.

Customer Experience is Paramount: The checkout process is the final hurdle between a potential customer and a completed sale. A clunky, untrustworthy, or restrictive payment experience is a primary driver of cart abandonment. Prioritise gateways that offer a seamless, mobile-optimised checkout and support popular payment methods like Apple Pay and Google Pay.

Scalability for the Future: The gateway that serves you perfectly today might not be the right fit in two years. If international expansion is on your roadmap, providers with strong multi-currency support and global payment method acceptance, such as Adyen or Checkout.com, should be high on your list. If you plan to introduce subscriptions, ensure your chosen gateway has excellent recurring billing features.

A Practical Framework for Your Final Selection

To move from analysis to action, consider these final steps. First, create a shortlist of two or three top contenders from our list based on your primary business model. Are you a small UK-based Wix store? Your shortlist might be Wix Payments, Stripe, and Square. Are you an established business planning a complex, international rollout? You might compare Adyen, Checkout.com, and Stripe.

Next, map out your projected costs. Use your average transaction value and expected monthly sales volume to calculate the effective fees for each provider on your shortlist. Remember to factor in any monthly charges, PCI compliance fees, or costs for add-on services like advanced fraud protection.

Finally, think about implementation. For a Wix store, the native integration of Wix Payments offers the path of least resistance. For others, consider the quality of documentation, API flexibility, and customer support available. A smooth setup process is vital to getting your store trading without unnecessary delays or technical headaches.

Choosing one of the best payment gateways for ecommerce is a foundational decision that directly impacts your revenue, customer satisfaction, and operational efficiency. It’s a strategic choice, not just a technical one. By aligning your selection with your specific business goals, whether that's local simplicity or global ambition, you empower your business with the financial infrastructure it needs to thrive. The right gateway doesn’t just process payments; it fuels growth.

Feeling overwhelmed by the technical details of setting up your ecommerce store and integrating the perfect payment gateway? The experts at Baslon Digital specialise in building high-performing, secure ecommerce websites on platforms like Wix, ensuring your payment systems are seamlessly integrated for maximum conversions. Contact Baslon Digital today to build an online store that’s ready for business from day one.